Pvm Accounting for Dummies

Pvm Accounting for Dummies

Blog Article

Rumored Buzz on Pvm Accounting

Table of ContentsThe Facts About Pvm Accounting RevealedThe Facts About Pvm Accounting UncoveredPvm Accounting Things To Know Before You Get ThisEverything about Pvm AccountingWhat Does Pvm Accounting Mean?The Ultimate Guide To Pvm AccountingThe Ultimate Guide To Pvm AccountingSome Known Factual Statements About Pvm Accounting

Among the primary reasons for carrying out audit in construction projects is the need for economic control and monitoring. Building and construction tasks often require substantial investments in labor, products, tools, and other resources. Correct audit enables stakeholders to keep track of and manage these financial resources effectively. Audit systems offer real-time understandings right into project prices, profits, and earnings, enabling task managers to without delay determine potential problems and take rehabilitative actions.

Audit systems enable business to monitor capital in real-time, making sure sufficient funds are readily available to cover expenses and satisfy economic obligations. Efficient cash flow administration aids protect against liquidity crises and keeps the task on course. https://myanimelist.net/profile/pvmaccount1ng. Construction tasks go through various financial mandates and reporting needs. Appropriate audit guarantees that all economic deals are tape-recorded precisely which the job adheres to accountancy requirements and legal arrangements.

Pvm Accounting for Dummies

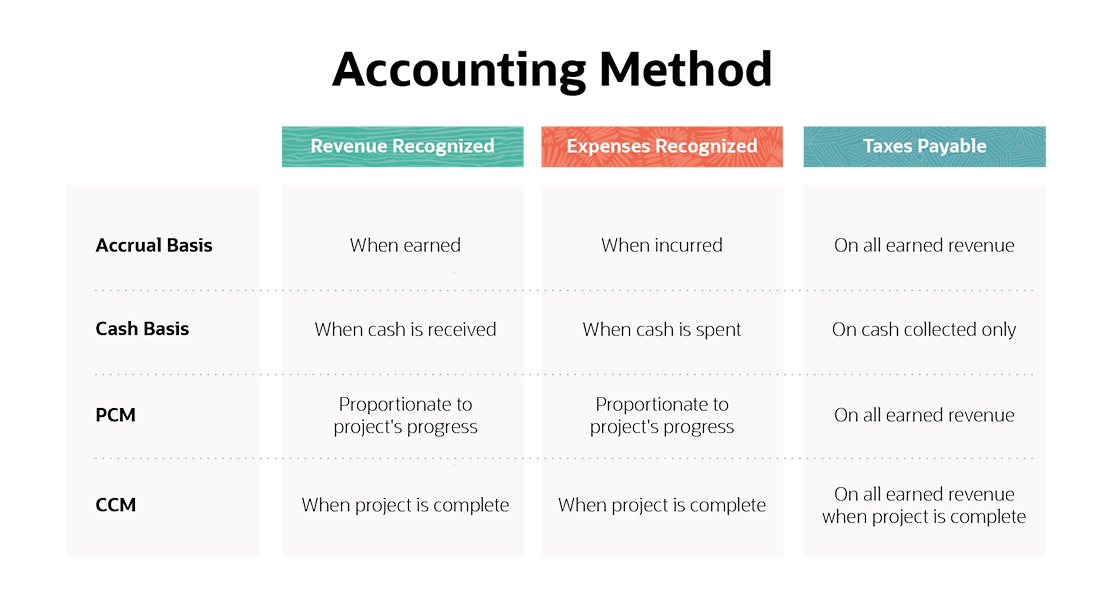

This reduces waste and enhances project effectiveness. To much better understand the importance of audit in building and construction, it's likewise vital to distinguish between construction monitoring audit and job monitoring bookkeeping. mostly concentrates on the financial facets of the construction company overall. It manages total monetary control, budgeting, cash money flow management, and monetary coverage for the entire organization.

It focuses on the monetary elements of individual building projects, such as price estimation, expense control, budgeting, and capital management for a specific project. Both types of accounting are vital, and they match each other. Building monitoring accounting makes sure the company's financial health and wellness, while task management bookkeeping makes sure the financial success of individual jobs.

About Pvm Accounting

A crucial thinker is required, who will collaborate with others to choose within their locations of responsibility and to surpass the locations' job processes. The setting will connect with state, college controller team, campus department personnel, and scholastic scientists. He or she is expected to be self-directed once the first learning curve is overcome.

Not known Factual Statements About Pvm Accounting

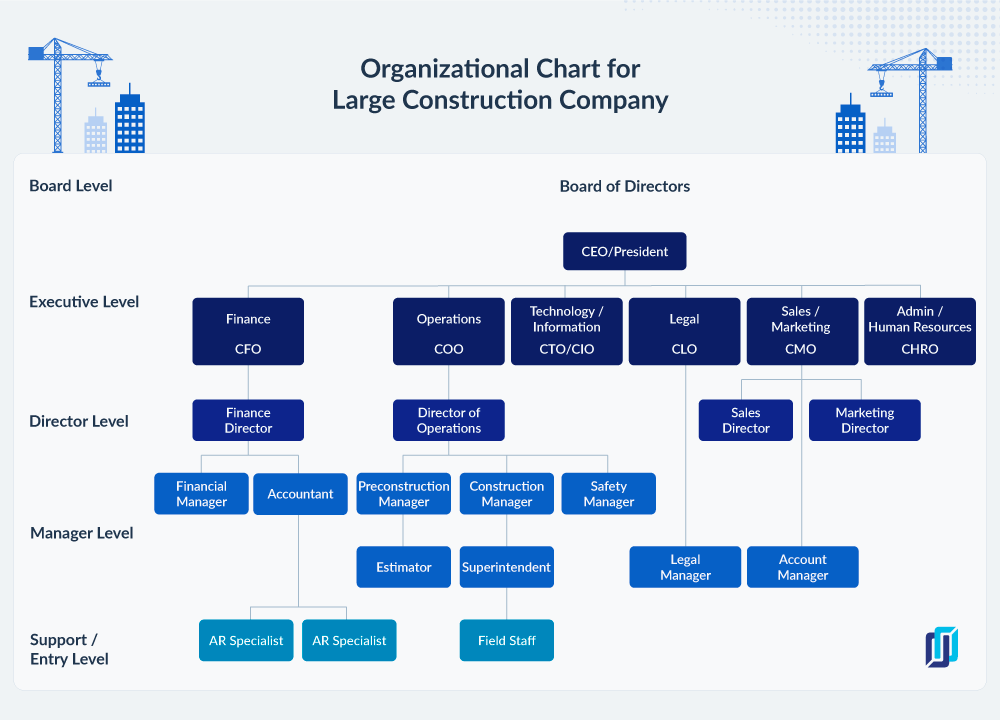

A Building Accounting professional is in charge of taking care of the monetary elements of construction tasks, consisting of budgeting, expense monitoring, financial coverage, and compliance with governing needs. They work very closely with task supervisors, professionals, and stakeholders to ensure precise monetary records, price controls, and timely payments. Their knowledge in building accounting principles, job setting you back, and financial analysis is crucial for reliable monetary management within the building sector.

Pvm Accounting Fundamentals Explained

Pay-roll taxes are tax obligations on a worker's gross salary. The earnings from payroll tax obligations are utilized to fund public programs; as such, the funds accumulated go straight to those programs instead of the Internal Earnings Service (IRS).

Keep in mind that there is an extra 0.9% tax obligation for high-income earnersmarried taxpayers who make over $250,000 or single taxpayers making over $200,000. Revenues from this tax go towards federal and state joblessness funds to aid workers that have shed their jobs.

The Only Guide to Pvm Accounting

Your deposits should be made either on a monthly or semi-weekly schedulean navigate to these guys election you make before each calendar year. Regular monthly settlements. A month-to-month settlement must be made by the 15th of the following month. Semi-weekly repayments. Every other week deposit dates depend upon your pay routine. If your cash advance drops on a Wednesday, Thursday or Friday, your down payment schedules Wednesday of the following week.

Take care of your obligationsand your employeesby making complete payroll tax obligation settlements on time. Collection and repayment aren't your only tax obligation responsibilities.

5 Easy Facts About Pvm Accounting Explained

Every state has its very own joblessness tax obligation (called SUTA or UI). This is since your firm's sector, years in service and unemployment history can all figure out the portion used to calculate the quantity due.

Examine This Report about Pvm Accounting

The collection, remittance and reporting of state and local-level taxes depend on the federal governments that impose the taxes. Plainly, the topic of payroll taxes entails lots of relocating components and covers a broad array of audit knowledge.

This website uses cookies to enhance your experience while you navigate through the site. Out of these cookies, the cookies that are categorized as required are stored on your browser as they are vital for the working of fundamental performances of the web site. We likewise utilize third-party cookies that assist us evaluate and understand how you use this website.

Report this page